Insights: Borrowing & Liquidations in DeFi 📉

A look into liquidations on popular borrowing protocols and a deep dive into the hottest new NFT project, CloneX by RTFKT.

23 December 2021

ARCx Insights

Welcome to issue #004 of ARCx Insights, our weekly newsletter for emerging trends, recent events and interesting analysis within the world of cryptocurrency.

This week we are joined by Sonja and Stuart who have written two pieces - first is a look at liquidations on popular borrowing protocols during periods of high market volatility, and second is a deep dive into CloneX by RTFKT (pronounced “artefact”), one of the hottest new NFT projects to hit the scene in the last couple of weeks.

Now let's get to it!

DeFi borrowing and liquidations

As we prepare to launch our own borrowing product powered by on-chain credit scores, we wanted to spend some time understanding user behaviour on existing borrowing platforms. By analysing on-chain activity, we hope to inform the design of our own system such that we can create the safest borrowing experience in DeFi.

To begin our analysis, we decided to look into liquidation events on Aave and Compound during periods of high volatility. These periods are not uncommon in crypto, and by analysing borrower behaviour we can gain a better understanding of how on-chain borrowing works and how to manage risk.

Case study: The crypto-crash of May 2021

For this analysis we are going to use the crypto crash of May 2021 as an example of what can happen during a sudden and unexpected dive in crypto prices. To refresh your minds, during May of 2021, the crypto economy experienced a massive dip. Over the course of a two week period, the price of ETH had dropped by almost 40%, with plenty of tokens following suit. This event was a little unexpected and caught many off guard, including many users who had taken on debt using these tokens as collateral. Borrowing platforms like Aave and Compound allow users to take out loans backed up by their crypto-assets. However, due to the volatile nature of these tokens, the loans are over-collateralised, meaning you can only borrow to a certain fraction of your collateralised value.

If the ratio of your loan to your collateral, know as Loan-To-Value (LTV), exceeds the required collateralisation factor, then your debt position may be liquidated. In this case, your debt is paid off by someone else in exchange for your underlying collateral, and you also pay a liquidation penalty. Having your position be liquidated is not ideal, and borrowers are encouraged to maintain healthy debt positions in case of periods of volatility.

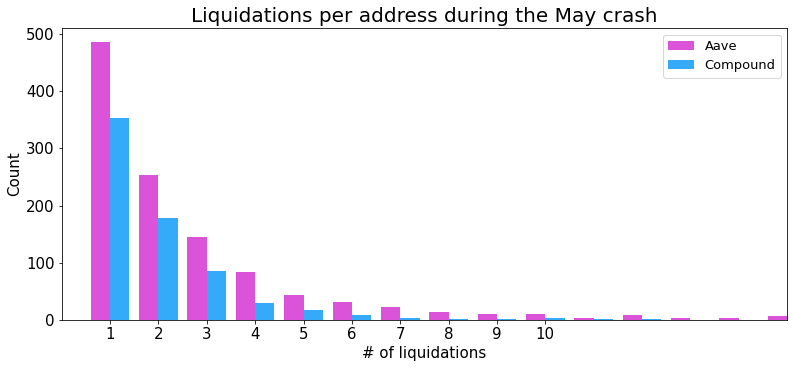

During the crypto crash in May, the value of many tokens nose-dived, along with the value of many users’ collateral. For those who weren’t quick enough to respond, their positions became under-collateralised and they faced liquidation. As a results the number of liquidations occurring each day peaked during the second half of the crash, with 714 address getting liquidated on Compound and 1168 address getting liquidated on Aave. 70 of these address were even liquidated on both!

Even within this group of liquidated addresses, some were unlucky enough to be liquidated multiple times. Certain positions are open for liquidation until that position become over-collateralised again, so a certain position may be liquidated repeatedly until this occurs.

For many users, borrowing platforms such as Aave and Compound offer convenient ways to use their crypto assets, by allowing them to collateralize their volatile assets that they do not want to sell (such as ETH and WBTC), and borrow stable assets against them (like USDC, DAI and USDT). The problem with this is that the value of their underlying asset is volatile, while their loan is stable. So, during the price drive in May, the value of the collateral fell relative to the loans, which drove many liquidations.

Of those addresses who were liquidated during the crash, we see that the assets they were borrowing were primarily stablecoins, while the collateral which was seized was primarily ETH/WETH and other volatile tokens such as LINK and WBTC.

Liquidation Indicators

Here we want to see if there are any indicators of whether a particular debt position or address is likely to be liquidated in a future market crash. To begin with, we look at the percentage of the addresses who were liquidated in the May crash who had previously been liquidated. Only a small fraction of them actually had, with 17% on Aave and only 8% on Compound.

What this tells us is that the majority of addresses were liquidated for the first time during the crash. This result is not too surprising. The crash in May came off the back of a significant bull run and some borrowers were likely feeling overly confident. This result illustrates that in periods of abnormal volatility, anybody can be caught out, especially if they are not paying attention.

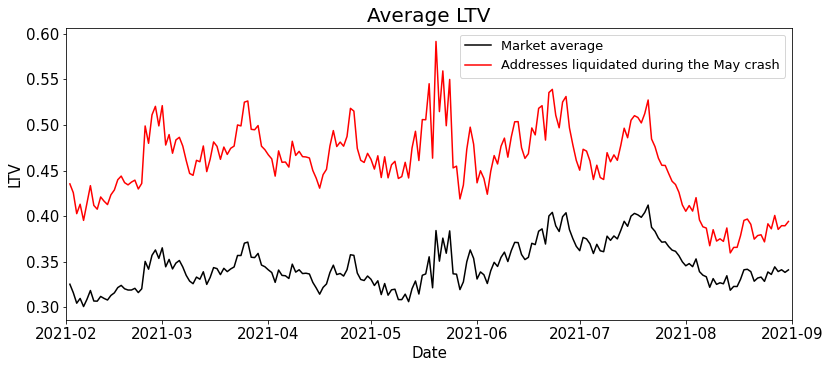

Borrowers should protect themselves by maintaining a healthy debt position, with a safe amount of collateral backing their debt, especially if they are borrowing stablecoins. This means maintaining a LTV that is in a responsible range, and not right up to the collateralisation factor. Looking at how these liquidated addresses maintained their positions compared to the market average, we find that this subset of borrowers had, on average, held their positions with a significantly higher LTV than the rest of the borrowing community.

It is not surprising then that these addresses were pushed to liquidation when their collateral value took a dive. Maintaining a prolonged debt position right up to the maximum borrow allowance is a risky position to take. Unfortunately, market crashes are inevitable and borrowers should remain vigilant.

To round off this analysis, we look at how many of these addresses learned their lesson. Did any of them lower their LTV ratios after the crash? We find that a significantly higher proportion of the addresses who were liquidated in the May crash went on to be liquidated again post-crash than had previously been liquidated pre-crash. Perhaps the allures of DeFi are just too strong...

Final remarks

Under-collateralised debt positions pose a risk to borrowing protocols and those that use them, as they essentially represent lost value from the protocol. Liquidation mechanisms are put in place to help prevent these cases from happening. However, in an ideal world, users would manage their debt responsibly so that these events never occur. By analysing on chain data in events such as the crypto-crash of May 2021, we can begin to build a model of risk around user behaviour and incentivise borrowing behaviour which benefits everyone.

CloneX by RTFKT Studios

CloneX by RTFKT Studios must be the most talked about new NFT project this month, launched in collaboration with artist Takashi Murakami. RTFKT Studios was recently acquired by NIKE who are moving further into the realm of crypto collectibles.

The key facts

CloneX is centered around the concept of human evolution to immaterial existence in the metaverse, where they will be represented by their CloneX avatar. These avatars are customisable, allowing their holders to express themselves while roaming the metaverse.

There are 20,000 avatars in total, all of whom have randomly generated traits and attributes. CloneX avatars are not cheap with a floor price of 4.85 ETH as of 22 December 2021.

Roadmap

The CloneX project is a bet on the metaverse and RTKFT Studios look to take the project beyond a pure consumerist concept by empowering consumers to create their very own customised avatar.

For 2022, there are plans for a clone meta vault, where 3D files can be kept for use across platforms. CloneX wearables will allow customisation of avatars and holders will have priviledged access to the RTFKT ecosystem and CloneX experiences.

The CloneX project targets consumers who may have been playing games like Minecraft previously and collecting items, offering a new way to own things, make friends and build a community.

The project is designed to retain consumers for the long term as this will allow them to benefit from future updates, airdrops and the CloneX ecosystem as set out by the roadmap.

Analysing the CloneX trade network

The below chart depicts the CloneX trade network (excluding mints), where the nodes stand for addresses and the edges stand for transfers. The network has 4, 632 nodes and 5,444 edges (as at 16th Dec). While not a large network, the CloneX token is certainly actively traded.

Who are the three most active addresses?

0x4748495153fb86637e4fdd8e50e3c1f611f15930

This address holds four erc-721 tokens only, DogeDash, Jadu Hoverboard, Lonely Planet Space Observatory and WhattyClub.

0x89cbb15c7ab08a39328b0e3ddf8cffa8d7c50899

This is an address that holds a broad variety of erc-20 and erc-721 tokens, with top balances including Doodles, ENS, TimeCatsLoveEmHateEm, Weth and Rari.

0x42de10a720c59ed8dcc6e55d5e61e03b5ad70905

Similar to the address above, this one holds a mix of tokens, including FRAX, Dinger, Cryptopunk and CharPunk.

The top three addresses are into a range of NFTs, but what about the wider CloneX community? What other tokens do they trade in and what does this say about them?

Most frequently traded tokens by CloneX addresses

The top three tokens traded by CloneX addresses are ENS, Wizards & Dragons Game (WnD) and GoldHunter (GOLDH). It seems that these addresses care about their representation in the metaverse, both in name (ENS) and appearance (CloneX) as well as the thrill of virtual adventures (the two latter NFTs are focused on treasure hunts).

A sense of being lucky

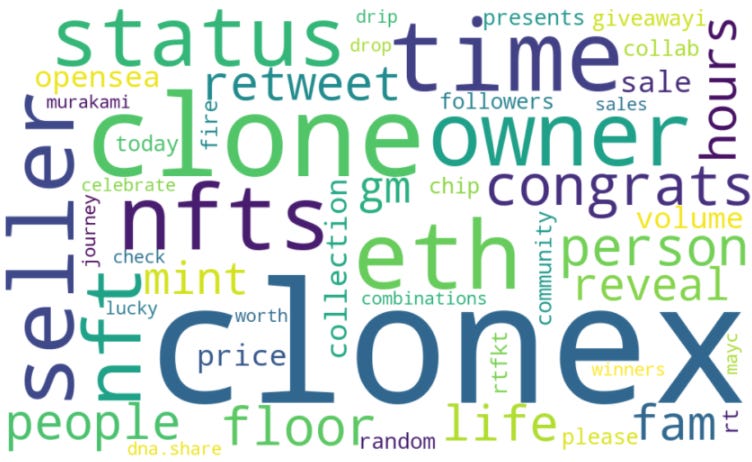

The word cloud below shows the most frequent words from Twitter tweets related to the CloneX project (data as of 16th Dec).

Overall, discussions appear to revolve around factual content however the tweets also convey a sense of being lucky ("lucky", "congrats", "celebrate", "winners"), perhaps relating to avatar reveals.

In summary

CloneX is undoubtedly an exciting project that has seen an excellent take-up. A key attraction of this project is to buy one high quality, customisable avatar that can be used across metaverse platforms. The project is designed to retain CloneX holders for the long-term as this will allow them to enjoy future utilities as well as the CloneX ecosystem.

Would you recommend this newsletter to your friends?

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10

(1 is hell no, 10 is absolutely)