Introducing ARCx Credit and the DeFi Credit Score

The safest and most capital efficient borrowing experience in DeFi

Reputation-based credit is a foundational element of mature and efficient capital markets. A lender’s effective and efficient evaluation of a counter-party’s credit risk, and the subsequent pricing of their overall cost of capital, is the core mechanism at the heart of global credit markets. Trillions of dollars of debt is issued, priced, and repriced daily as the global credit market interprets a constant flow of new and historical data that forms a counter-party’s reputation.

Despite the important role that reputation plays in mature financial markets, DeFi lending has historically relied on indiscriminate mechanisms of risk management, where all borrowers are treated equally, and given the same terms regardless of the real or historical credit risk they represent. DeFi market participants are largely unidentified, and lenders have no clear legal recourse against defaulting parties. The lack of an identity and reputation layer in the DeFi stack has forced the first generation of crypto credit markets to depend on highly inefficient collateral mechanisms to ensure credit markets remain solvent. These mechanisms require substantial capital buffers due to the high volatility of collateral assets. Market participants gain no advantage over time for being a creditworthy borrower, and are subject to the same onerous collateral requirements and interest rates as those participants with a poor or inexistent track record.

Building accurate and efficient reputation-based credit markets would represent a step-change innovation for the DeFi lending industry, unlocking immense efficiencies.

It would offer material improvements in the cost of capital for a large proportion of borrowers who already demonstrate effective risk management behaviors.

It would allow the most sound and creditworthy borrowers to increase their capital efficiency over and above that of other participants, providing a significant competitive advantage.

It would allow lenders to supply liquidity preferentially based on the credit risk of individual borrowers, leading to the formation of a credit spread between different risk profiles.

The development of an effective reputation layer supporting DeFi credit represents the next major frontier for crypto finance.

Over the past 12 months, the ARCx team have been focused on developing reputation-based credit markets in DeFi. ARCx is delivering a data-driven system that is not subject to the fundamental flaws of the legacy, centralized lending market which has grown to undermine the founding principles of our industry. Today, we are excited to announce the ARCx Credit Protocol and the DeFi Credit Score, our first step toward realizing this vision.

ARCx Credit Protocol and the DeFi Credit Score

ARCx Credit is a decentralized credit market launching on the Polygon network that offers dynamic maximum-LTV loans on ETH collateral based on a borrower’s DeFi Credit Score. The DeFi Credit Score provides a credit risk assessment for individual wallet addresses based on historical on-chain borrowing activity. Through these systems, borrowers who use ARCx Credit will build their DeFi Credit Score and progressively unlock greater capital efficiency on their crypto-collateralized loans.

At launch, borrowers who hold a DeFi Credit Score of 999 will have access to 100% maximum LTV loans on their ETH collateral.

But this is just the beginning 🚀

While today we are focused on using the DeFi Credit Score to improve capital efficiency through serving personalized maximum-LTV ratios, the next iteration we are working toward will aim to improve the overall cost of capital for borrowers.

In the sections below, we explain the specific problems we are solving today, how the ARCx Credit Protocol and the DeFi Credit Score work (including how we manage risk and profitability), and how you can get started with out Beta Program.

The problem we are solving today

The efficient use of leverage is a key objective for most investors. However, in DeFi lending markets, capital efficiency is constrained by the onerous collateral requirements found in first generation lending protocols. This constraint is driven by two main factors:

The crypto assets used to collateralize loans are highly volatile and illiquid

The borrowers are pseudonymous and the lenders lack any financial or legal recourse in the event of unprofitable liquidations (i.e. toxic debt)

To account for these constraints, lending protocols have historically imposed high collateral requirements on their loans. As an example, borrowers may only take on $0.80 worth of debt for every $1.00 in ETH collateral they deposit before their positions are subject to liquidation.

Rather than evaluating risk at the individual level, protocols impose the same collateral requirements on every borrower equally, regardless of their track record. By offering the same collateral requirements to every borrower, we believe this model effectively penalizes the “safe” borrowers with less capital efficiency than they deserve.

Some findings from the data

We believe the issue is particularly unfair to “safe” borrowers given that “risky” borrowers represent a very small percentage of the overall borrower population, yet they account for a large proportion of the liquidated debt in the market.

When analyzing wallets prior to the May 2022 market crash, we found that only 13% of addresses on Compound Finance had been liquidated at least once in the past.

At that point in time, those previously-liquidated users held onto just 8% of the outstanding debt in the system.

Yet over the two weeks that followed, as the crypto markets crashed in early May, a total of 35% of all liquidated debt was attributed to these previously-liquidated borrowers.

This short analysis demonstrates that there are real on-chain behaviors which indicate the risk level of DeFi borrowers. In this example, although liquidated addresses accounted for only a small percentage of the total debt, they resulted in a much larger portion of the liquidated debt. The outsized risk introduced by this minority necessitate strict collateral requirements in indiscriminate credit protocols, leaving the majority of responsible borrowers with unnecessarily poor borrowing conditions.

How the DeFi Credit Score Works

The DeFi Credit Score is based on three main components:

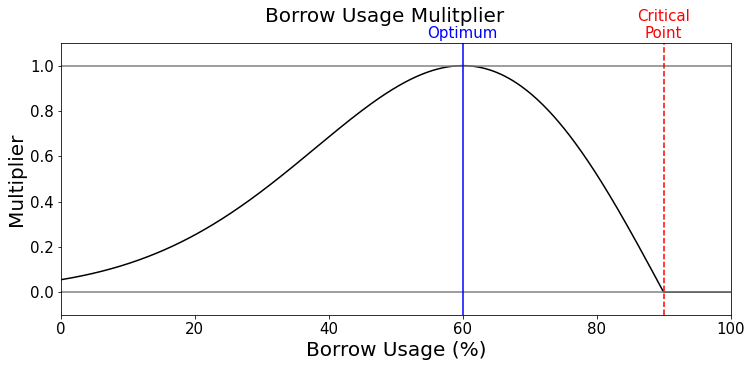

(1) Daily Score Reward: Evaluates your “borrow usage” (current LTV as a percentage of max LTV) on ARCx Credit vaults over the prior 120 days relative to a “responsible” borrower archetype and rewards points according to a “Rewards Curve” on a daily basis. In our current iteration, the number of points earned each day peaks when a position is held at 60% borrow usage, and tapers off toward the lower (more conservative) or higher (more aggressive) ranges of the risk curve. The choice of 60% was based on an analysis of experienced stablecoin borrowers on Compound Finance who use ETH as collateral (i.e. it represents balanced risk exposure given the expected volatility of ETH).

By aligning the growth of the Credit Score with borrow usage, we aim to discourage excessive risk exposure, and by extension, mitigate the risk to the protocol and to lenders

Note, as discussed below, the shape of the Rewards Curve, including the optimal borrow usage and the amount of drop-off left or right of the optimal point, are parameters set by the Risk function. Thematically, our system affords significant control over a number of unique parameters that help control risk and manage profitability. Further, as our system evolves, we intend to make changes that will enable borrowers who have built trust with ARCx Credit to maintain their Scores while borrowing at their desired risk levels.

(2) Survival Score Reward: Evaluates a borrower’s ability to avoid liquidations on any indexed third-party platform relative to the rest of the market, rewarding or subtracting points proportional to the “liquidation density” on a given day. Unlike the Daily Score Reward, which looks only at the previous 120 days of borrowing experience on ARCx Credit, the Survival Score Reward considers the borrowing experience of a wallet address over its entire lifetime outside of ARCx Credit. The maximum number of points a borrower can earn from the Survival Score Reward is 300. This means that to reach a Score of 999, borrowers must build experience with ARCx Credit vaults.

(3) Liquidation Penalty: Subtracts a fixed number of points for every day in which a liquidation occurs. The penalty only applies for 120 days, similar to the Daily Score Reward. After this period, the penalty is removed from the Borrower’s score.

How do I unlock better capital efficiency?

A user who grows their DeFi Credit Score through responsible borrowing will unlock greater capital efficiency from their collateralized crypto assets within ARCx vaults. This is primarily achieved by mapping the DeFi Credit Score (a value between 0 and 999) with a range of maximum LTV ratios for each vault.

To support this, we have implemented a three-tiered vault design, with each collateral asset having three distinct vault options distinguished by the range of max LTVs offered (”capital efficiency”), the minimum Score required to access the vault (”score threshold”), and the maximum amount of debt a borrower can access (”credit limit”).

Capital efficiency describes the range of max LTV ratios that the vault offers depending on the borrower’s DeFi Credit Score. For example, a borrower with a score of 0 will have their position in the WETH-A vault liquidated at a max-LTV of 80%, while a borrower with a score of 999 will be liquidated in the same vault at a max-LTV of 90%. Because the DeFi Credit Score changes daily, so too will a borrower’s maximum LTV offered across different vaults. Additionally, while the “optimal” borrow usage for growing the DeFi Credit Score stays constant across vaults (e.g. at 60%), the specific LTV that this borrow usage represents increases in higher tiered vaults.

Score thresholds prevent access to higher-tiered (i.e. more capital efficient) vaults until the borrower achieves the minimum DeFi Credit Score required. By default, everyone has access to the “A” vault, as it has a score threshold of 0. Vaults “B” and “C” offer comparatively higher maximum LTV ratios, and are gated to lower risk borrowers who achieve Credit Scores above the thresholds set. Should a borrower’s Score fall below the threshold, they will be unable to borrow more until their score returns to the required level.

Credit limits create a ceiling to the amount of debt that an individual can borrow from a specific vault. Rather than allowing a user to borrow an unlimited amount, the credit limit provides a way to limit the quantum of losses born through unprofitable liquidations, particularly for higher tiered vaults. To more explicitly tie borrower behavior with the amount of debt we feel comfortable extending, credit limits for an individual vault can be determined dynamically based on the amount a user has borrowed in other vaults.

How we manage risk

The ARCx Credit protocol has been designed to avoid excessive exposure to any single party, and to rely on empirical data and rational incentives instead of trust.

The DeFi Credit Score is based on real statistical indicators of credit risk, and contains no subjective analysis of a debtor’s profile based on their identity. Trusting a brand name fund, trading desk or other market participant has proven to be extremely hazardous, subject to significant tail risks and the possibility of fraud. We believe that trusting on-chain data levels the playing field for market participants and will prove itself as a more reliable indicator for credit risk.

The rules of the DeFi Credit Score are transparent and easy to understand. Instead of building a “black box” machine learning model that ingests hundreds of data points to return a result, we enable lenders to do their own research to understand the counter-party risk of our users. Through explaining the rules clearly to both parties and publishing updated scores on-chain each day, we are providing the tools for lenders to evaluate the performance of our risk modeling more than other credit scores are willing or able to do. Ultimately the market determines the probative value of our scoring, and will price their liquidity accordingly.

ARCx Credit and DeFi Credit Score system health KPIs are monitored and publicly available to track for lenders, borrowers and investors alike. As discussed below, we control a number of parameters that influence how much risk we introduce into the system. Making this data and the process by which different parameters are updated more transparent is critical to building trust with market participants. We currently publish system health reports on our Community Discord Server every day, and we also publish a weekly report with commentary on Fridays. This is an area we will continue to evolve over time.

The three-tiered vault design and the addition of a dynamic credit limit based on previous borrowing actively prevent exploitation and debt concentration risk for the protocol. If a user deposits $1 worth of ETH, and borrows perfectly until they have a Score of 999, they will not then be able to borrow a large sum of money in Vault C.

How we manage profitability

Protocol net profit is equal to the sum of fees generated by Borrowers (through interest, borrow fees and liquidations) minus the losses they incur to the protocol (through unprofitable liquidations). Borrowers in the highest tiered vaults pose the greatest risk to profitability, since liquidations there may lead to the accumulation of toxic debt in the system (i.e. debt which is not recoverable by liquidating the underlying collateral).

To manage and optimize profitability, the ARCx Credit system provides a number of unique control parameters. Through understanding, monitoring and fine-tuning these parameters, ARCx Credit will deliver sustainable net profit across its loan book.

If you are interested in learning more or contributing to the discussion around these parameters (and other aspects of risk), feel free to join our Community Discord server and dig into our documentation.

How we incentivize responsible borrowing

The design of ARCx Credit and the DeFi Credit Score aim to incentivize responsible borrowing behavior. This is based on two unique factors:

The time and effort required to build to a high DeFi Credit Score (which would be a sunk cost if a wallet is abandoned after liquidation)

The quantifiable benefit that a borrower receives from continued access to higher-tiered vaults (i.e. the capital efficiency gained)

Since the growth of the DeFi Credit Score is explicitly tied to responsible borrowing behavior, users who want access to improved capital efficiency will be incentivized to borrow responsibly. Conversely, if the expected benefits of continued access to improved capital efficiency exceed the penalty for liquidation and the time and effort required to rebuild a Score, then borrowers will be incentivized to avoid liquidation.

Joining the Closed Beta

Today we are launching the Closed Beta for ARCx Credit and the DeFi Credit Score. To ensure the system works as expected and to allow us time to refine our risk parameters, we have created a waitlist which you can join now. We will progressively whitelist addresses over the coming weeks and months before a wider release following our audit with Trail of Bits in mid-October 2022.

To get started:

Visit https://arcx.money

Add your email address and click “join waitlist”

Fill in our optional research survey (this just helps us improve our product)

We’ll send you an email when your address is whitelisted

What’s next

We will have a number of updates and announcements to make over the coming weeks and months relating to ARCx Credit and the DeFi Credit Score. Additionally, we regularly publish reports on the state of our system for the benefit of our community.

To stay up to date with everything, join us on Discord and Twitter.