Recently we launched ARCx Credit: a decentralized credit market on the Polygon network that offers dynamic benefits to borrowers through the use of the DeFi Credit Score. The DeFi Credit Score provides a credit risk assessment for individual wallet addresses based on historical on-chain borrowing activity. Borrowers who use ARCx Credit will build their DeFi Credit Score and progressively unlock greater capital efficiency on their crypto-collateralized loans.

As part of our initial launch, we allowed borrowers who hold a DeFi Credit Score of 999 to access up to 100% maximum Loan-to-Value on their ETH collateral, offering the most capital-efficient borrowing in DeFi. This was the first of many benefits that top-scoring addresses can expect and we are actively working on building more.

Today we are excited to announce a new feature of the ARCx Credit product! This new feature will allow borrowers more flexibility in choosing the level of risk on their ARCx loans. As a result, high-scoring addresses will have greater control of their positions while still maximising their score growth and increasing their capital efficiency above what we are already offering. In this article, we explore the main components of the DeFi Credit Score that let borrowers access these benefits.

If this sounds good, read on!

👉 To learn more about the DeFi Credit Score, have a look at our docs!

Poor debt management and mass-liquidation events

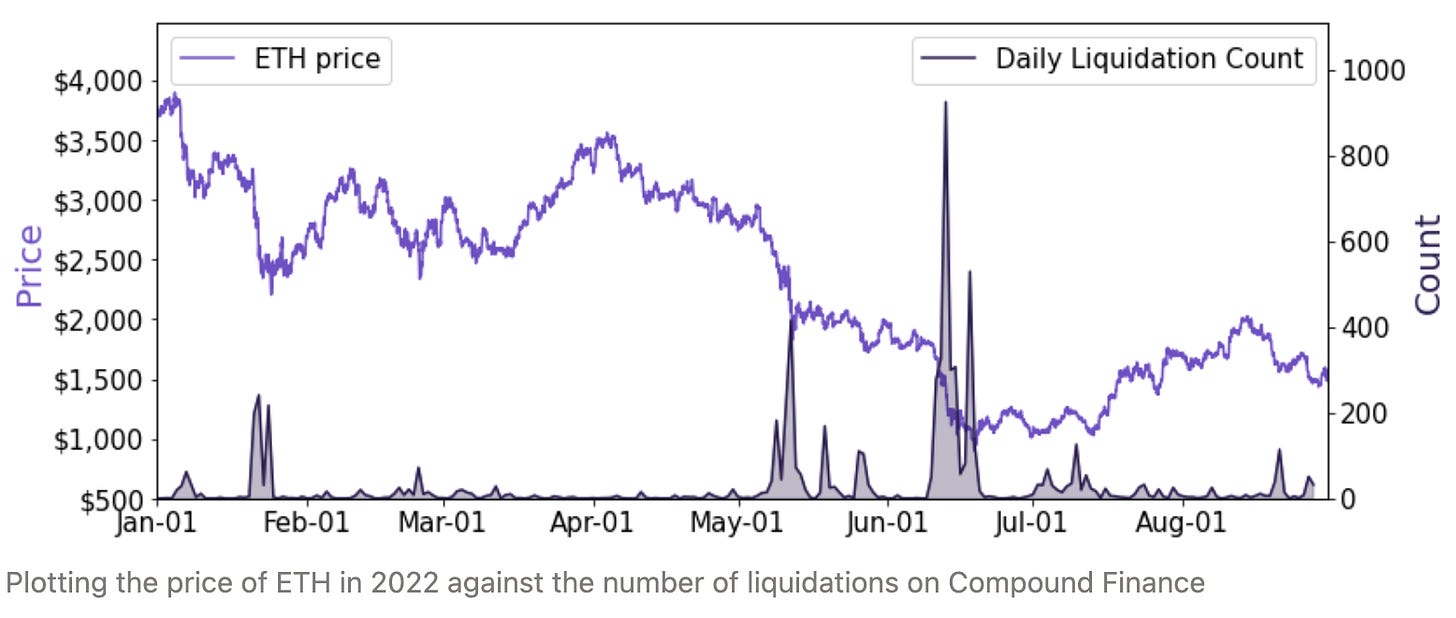

Every now and then the crypto market experiences a crash. These crashes typically see the prices of well-known tokens falling more than 20% in a matter of days. This is a dangerous situation for the thousands of borrowers across the many lending platforms in DeFi, who may be at risk of liquidation. While most DeFi lending platforms operate using over-collateralised loans, if the value of the underlying collateral falls enough relative to the debt, the positions will be liquidated.

In times of calm, borrowers have less worry about their positions becoming under-collateralised, and this leads many borrowers to maintain risky positions without a sufficient buffer between their debt and their liquidation point. This becomes evident once the value of the borrower’s collateral falls dramatically, catching them off guard and leading to a liquidated position. Unfortunately, this is often the case for many borrowers, and large market crashes lead to mass-liquidation events.

During these events, millions of dollars worth of collateral are liquidated. Situations like these could be avoided by setting more appropriate risk levels when borrowing against volatile assets such as ETH. As these positions are typically over-collateralized, the cost of liquidation is placed purely on the borrower and the protocol remains safe. This safety comes at the cost of lower capital efficiency.

Unlike other DeFi lending protocols, ARCx Credit allows borrowers to take out up to 100% maximum LTV loans. Such loans are inherently risky; as soon as the collateral value drops, there is no incentive for the borrower to repay their debt, as liquidating their position would result in a net loss, termed “toxic debt”. In these cases, both the borrower and the lender are negatively affected. To combat this risk, we have designed the DeFi Credit Score such that only the most experienced and trustworthy borrowers will access these benefits. By helping borrowers better manage their debt positions, we can lower the likelihood of mass liquidations; a positive outcome for borrowers and lenders alike.

Daily Score Reward

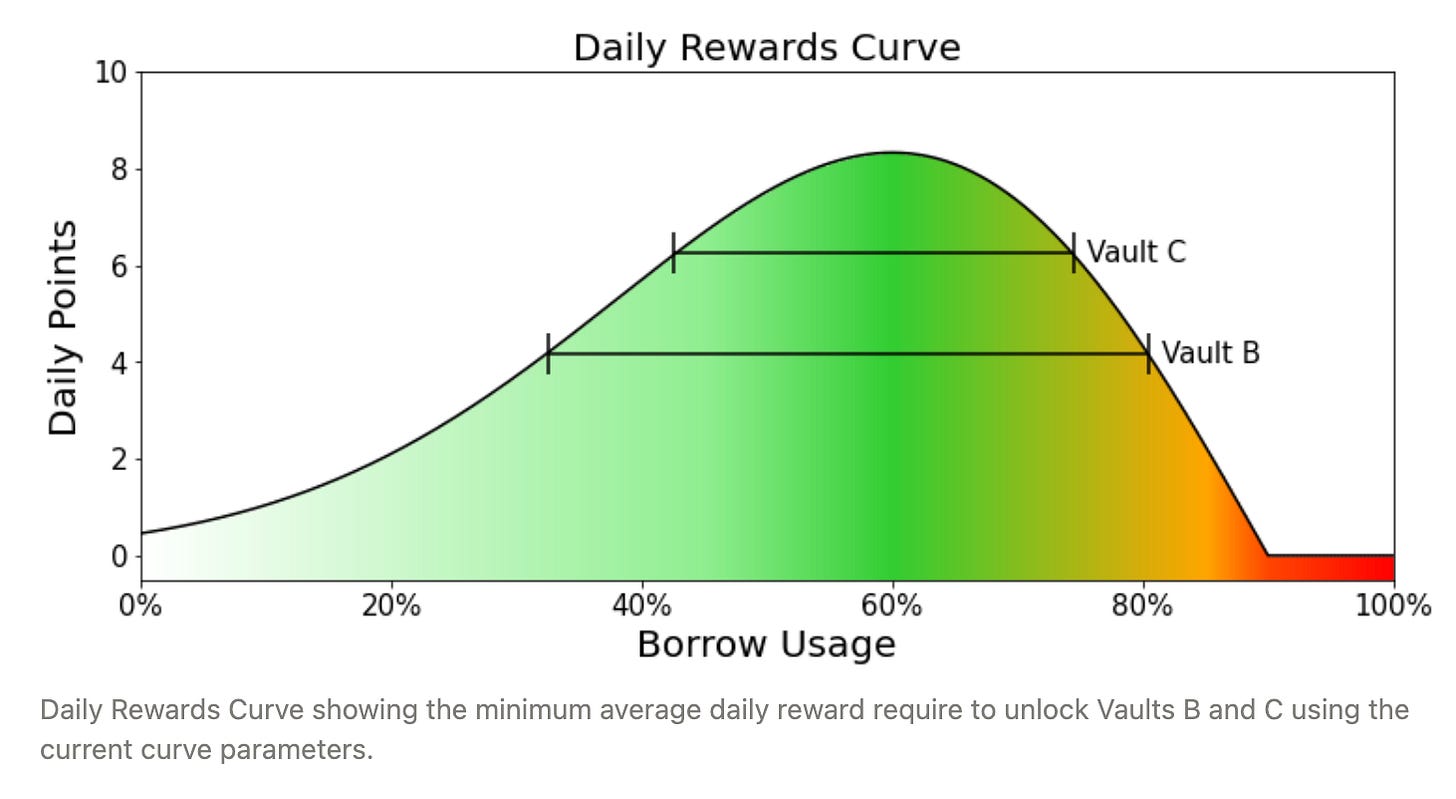

Reaching a high DeFi Credit Score is largely predicated on optimal loan management, determined by the Daily Score Reward component of the score. This component evaluates current debt positions on ARCx Credit vaults relative to a “responsible” borrower archetype and rewards points according to the “Rewards Curve” on a daily basis.

Each day we measure a borrower’s aggregate “borrow usage” (current LTV as a percentage of maximum LTV) and use the Rewards Curve to calculate the number of score points to award them for that day. We then sum all the rewards for the past 120 days to create the Daily Score Reward component.

The shape of this curve was designed with the following considerations in mind:

Borrowing too close to the limit (i.e. borrow usage close to 100%) puts a borrower at risk of liquidation if the collateral price crashes and should be disincentivised.

Borrowing only a small fraction of the available capacity (i.e. low borrow usage) is not an efficient use of collateral and is also disincentivised.

Through extensive analysis of historical market movements and indicators of responsible borrowers on third-party lending platforms, we classify a borrower who maintains a debt position at 60% of their available credit represents an ideal borrower. This means that the price of the underlying collateral would have to fall by 40% before the debt position is liquidated. The optimal value of 60% sets a conservative safety buffer against the volatility of WETH collateral, while still providing the borrower with sufficient access to credit.

The Rewards Curve defines a continuous points allocation based on the aggregate borrow usage each day. The curve reaches zero at the “critical point” of 90%, above which no points are awarded each day. Explicitly, the shape for the curve above is determined by the following equation:

Where:

The strategy to maximise this score component is simple: “Stay in the Green”. A borrower who maintains their position near to this optimal point will grow their score the fastest, according to the Rewards Curve. The further the position strays from this optimum range, the lower the daily reward for that borrower. The maximum amount of points obtainable on each day is α = 999 / 120 = 8.325. To reach the top score of 999, one must borrow optimally for the entire 120 day window and avoid liquidation.

This system was designed to prevent borrowers from taking on too much of their available credit and exposing themselves (and the ARCx protocol) to higher risk, while also encouraging efficient borrowing.

Gaining the benefits

As their score increases, the borrower unlocks progressively higher maximum LTV values and unlocks higher-tier vaults. Higher maximum LTV ratios allow access to more and more credit. Note, the score rules still incentivise the borrower to only access a responsible amount of that credit (i.e. 60%). A common question we are asked is:

How can I benefit from better capital efficiency if I have to keep borrowing “optimally” just to unlock it?

As the maximum LTV increases with the Credit Score, the amount of available credit increases, which means that the optimal amount corresponds also to a higher amount. A higher maximum LTV allows the borrower to take on more debt for the same amount of collateral, and the same risk appetite. Let’s look at an example.

Consider a borrower who has deposited $1,000 of WETH into Vault A. At a starting max-LTV of 80%, the borrower has access to $800 of credit. In order to grow their score most efficiently, the credit score rules require that they borrow near to 60% of that available credit - that is $480. As their score improves, they are able to unlock up to 90% max-LTV in Vault A. By maintaining the same level of risk, this higher max-LTV allows the borrower to borrow an extra $60, extending their line of credit for the same amount of underlying collateral and the same buffer to liquidation. By switching to higher-tier vaults, they can access even more!

We understand that for some borrowers, the value of 60% borrow usage will not align with their own appetite for risk. Of course, a borrower does not need to manage exactly 60% of their available credit. The borrower is free to choose whatever risk level they wish, however the credit score will grow in reflection of this choice. Some borrowers will want to obtain more leverage, knowing that they are capable of managing a riskier position. Others may wish to set an even more conservative buffer than we prompt.

💡 To give an idea as to how the Daily Score Reward works to unlock vaults and capital efficiency, consider a borrower who starts with a score of 0.

In order to unlock Vault B, they must first borrow in Vault A until their score exceeds the threshold of 500. This is equivalent to a minimum average daily reward of 4.2. The borrower can achieve this simply by borrowing within 32.5% and 80.5% of their borrow usage. This unlock range is indicated in the figure below.

To unlock Vault C, the borrower needs a score of 750 or above**.** This requires on average a daily reward of 6.25, which can be obtained by borrowing within 42.5% and 74.5% of their usage for the full 120-day window. To stay in the vault, the borrower just needs to maintain that average.

Having a non-zero Survival Score helps to increase a borrower’s range of usage by lowering the required average daily reward needed to unlock certain vaults. See our docs for more information!

To acknowledge the different risk appetites of our users, we are excited to announce that we are changing how the Daily Score Reward is calculated, to allow experienced borrowers to have more flexibility in setting their borrow usage.

Dynamic Rewards Curve

Progressing to a higher score means that a borrower has shown that they can responsibly manage their debt. A high score gives us more confidence that the borrower is proactive enough to react to market conditions and avoid liquidation. For this reason, we are altering the Rewards Curve for each ARCx vault to reflect this. As a borrower unlocks higher-tier vaults and takes loans from them, their Daily Score Reward will be calculated based off a broader curve, which means they will not be penalised as heavily for not sitting near 60% borrow usage.

As we discuss in our docs, we have multiple control parameters to adjust the level of risk in the system. The configuration of the Rewards Curve is one of them. In particular, we can modify the ‘critical point”, β, of the curve to change how easy or hard it is to grow the score. A higher value of β corresponds to a broader curve and less strict enforcement of the score rules. A lower value of β means a narrower curve and a tighter enforcement of the rules.

For our launch, we implemented the same Rewards Curve for each ARCx vault. From today, the reward curves will be configured with the following parameters:

With these parameters, the curves are shown in the figure below.

❓ What do these changes mean for borrowers?

The curve for Vault A is now narrower, meaning it is harder for new borrowers to grow their score. To unlock Vault B, a borrower must remain within 41.5% and 73.5% borrow usage to obtain an average daily reward sufficient to reach the score threshold.

The curve for Vault C is now broader, meaning it is easier for borrowers who reach Vault C to remain in Vault C. In order to do so, borrowers must stay within 37% and 79% usage once they have access to the vault.

The curve for Vault B remains unchanged.

❓ What do these changes mean for the protocol?

There are two main effects of these changes:

Experienced borrowers are given more freedom for their borrow position to drift in Vault C without their score dropping too much and locking them out of the vault. We believe this is an added benefit to the improved capital efficiency they already receive.

Inexperienced borrowers must manage their positions more closely if they want to progress their scores. To help with this, we have a helpful utility on our product which optimises a borrower’s position to 60% borrow usage with just a click of a button! Doing this frequently will ensure maximum score growth.

With our design we hope that responsible borrowers will be able to progress through to higher-tier vaults, while irresponsible borrowers will remain locked out. Once a borrower has access to the benefits, we want them to be able to enjoy them without worrying that they might lose them at any point.

Dynamic Liquidation Penalty

By broadening the Rewards Curve in Vault C, we are allowing experienced borrowers who have demonstrated strong management of their position to be more relaxed with optimising their positions. However, we do not want this added flexibility to lead to complacency. As we discussed, complacency is a leading cause for mass liquidations during a market crash - a scenario we want to avoid.

Borrowing with a maximum LTV of 100% brings the most risk to both the borrower and the protocol. We hope that borrowers in Vault C will still be paying close attention to their positions and will take necessary actions to avoid liquidation. To further incentivise this behaviour, we will be changing the Liquidation Penalty in each vault to reflect the severity of the outcome. We will be implementing the following penalties based on the vault in which the borrower is liquidated.

Being liquidated is a demonstration of poor borrowing behaviour. It is especially undesirable when the liquidation occurs in Vault C, where a position close to 100% LTV can leave toxic debt in the system. This is a negative outcome for borrowers, suppliers and the protocol. A borrower who is liquidated in Vault C will be significantly penalised for doing so and will lose access to Vault C until the penalty is removed.

Removing a penalty occurs once the liquidation event is no longer in the 120-day observation window. We also recognise that some borrowers may be caught out in a flash crash and be liquidated, despite their best intentions. While we would prefer all borrowers to avoid this scenario, we also acknowledge that some borrowers may not be at fault, and are victims of poor timing. To enable borrowers to regain their Credit Score and the benefits that come with it. We will soon be implementing a new feature that allows borrowers to repay the toxic debt they accrued to the platform and thus regain their credit-worthiness

Summary

Although we have just launched ARCx Credit, we are still hard at work on new and exciting features. Our goal is to bring all the benefits of a reputation-based credit market to DeFi, and we are excited about bringing this vision to life. Today marks another step in this process, by expanding the rules of the DeFi Credit Score to increase the benefits for our borrowers.

If you want to be a part of this journey, come and join our waitlist to start building your DeFi Credit Score and benefits today!